what to expect from charter communications inc. in 2019

Introduction

Nosotros review our investment case on Charter Communications, Inc. (NASDAQ:CHTR) afterward Q2 2021 results were released on Fri (July thirty).

We initiated our Buy rating on Lease stock in January 2020, and since and then CHTR shares accept gained 51%. Yr-to-engagement, Charter has gained 16.v%, significantly alee of telcos AT&T (T) and Verizon (VZ), though approx. five ppt behind Comcast (CMCSA) (Purchase-rated in our coverage) and the S&P 500 index:

Q2 2021 results showed Lease continuing on its multi-year compounding journeying, thanks to the same structural drivers every bit before. Our updated forecasts show a total render of 62% (15.two% annualized) by 2024 year-terminate.

Charter Buy Example Recap

Our investment instance on Charter has been based on its Free Cash Flow Per Share ("FCF/Share") growing at a high-teens CAGR, driven past its focus on the stable U.S. Cable business organization and leveraged capital structure, including:

- Rising Cyberspace customer numbers and Average Revenue Per User are the main drivers for revenues and profits, thanks to structural demand growth, the quality of Charter's infrastructure and limited local contest

- Video customer losses take little impact on profits, every bit they are offset by falling Programming Costs, and Video revenues were already low-margin

- Overall revenues are growing at low-single-digits; margin is rising from mix and stable service costs, so EBITDA is growing at high-single-digits

- Financial leverage and stable CapEx turn a loftier-unmarried-digit EBITDA growth into a low-teens total FCF growth

- Buybacks, financed by FCF and new borrowings in line with a rising EBITDA (at a 4.0-4.5x leverage target), drive FCF/Share growth to high teens

- The nascent Mobile business produces only limited cash losses in the short term and represents a big potential upside in the long run

- The valuation at a depression-single-digit FCF Yield will remain stable

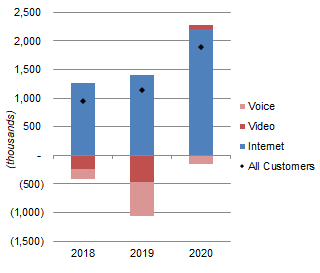

The need for Internet connectivity at dwelling during COVID-19 has been positive for Charter. Its Internet customer base was 8.3% (2.22m) higher year-on-yr as of Q4 2020, and it grew EBITDA past 9.ix% and full FCF past 56.v% in 2020. 2021 Cyberspace net adds are guided to be at or higher than 2019 (1.41m).

Charter Cablevision Customer Net Adds by Category (2018-20) NB. Include customers on COVID back up programs. Source: Charter visitor filings.

Charter has alleged an intent for its Mobile business to be the "predominant" provider in its local markets equally part of its Q1 2021 results. Mobile has a negative EBITDA but is profitable excluding marketing and sales costs.

Q2 2021 results showed how each of the key components in our investment instance for Charter Communications continues to progress.

Internet Business Continues to Grow

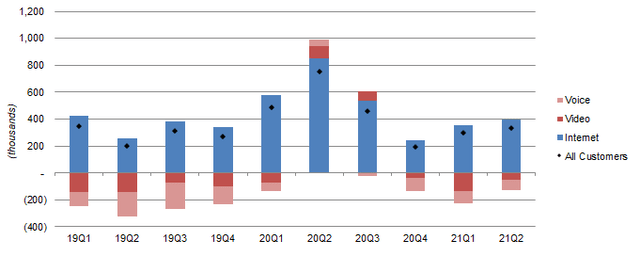

In Q2 2021, Charter's number of Internet customers increased past another 400k to accomplish 29.6m, 5.5% higher than the prior-twelvemonth quarter; there were the usual modest losses in Video and Voice customers, merely the overall customer count grew by 332k in Q2 and was up 4.2% year-on-year:

Q2 client figures included a small-scale number who benefited from the Emergency Broadband Benefit program launched in May (60k in Internet) or from certain state-mandated moratoriums on disconnections (40k in Internet, less in Video and Voice). Q2 Net net adds would still be a solid 300k with these adjusted out. Lease has generally been able to retain customers from such relief programs after their expiry, including for the Keep Americans Continued program in 2020.

Q2 was also a quarter where residential customer activity "remained lower than normal" due to COVID-19, which reduced churn just was a net negative to net adds for market place share gainers like Charter. Lease remains the share leader in its local markets and sees no changes in competitors' overbuild:

We keep to meet a similar market that we've seen for a number of years now in terms of competitive overbuilds. Nosotros're standing to do well everywhere we operate. Nosotros are the share leader everywhere nosotros operate competitively speaking.

Tom Rutledge, Charter CEO (Q2 2021 earnings call)

Charter's internet adds in 2021 year-to-date has indeed been at or similar to pre-COVID 2019 levels equally management expected; total Cyberspace net adds were 755k in H1 2021, compared to 686k in H1 2019:

Charter Cablevision Customer Net Adds by Category (Since 2019) NB. Include customers on COVID support programs. Source: Charter visitor filings.

Q2 2021 Internet revenues grew 15.two% year-on-yr and ii.vii% sequentially, faster than the number of customers (which grew 5.v% and 1.4% respectively), due to both COVID-related relief programs in 2020 and a continuing growth in Boilerplate Price Per User.

Double-Digit Year-on-Year EBITDA Growth

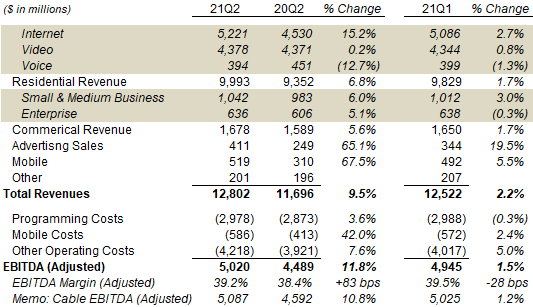

College Internet revenues (by $691m) provided the main commuter for overall revenues to exist 9.five% ($1,106m) higher yr-on-twelvemonth in Q2 2021. EBITDA grew past 11.viii%, faster than revenues, with margin expanding 83 bps:

Charter Revenues and EBITDA (Q2 2021) Source: Charter results schedule (Q2 2021).

Other revenue lines besides showed a strong recovery from the COVID-impacted prior-year quarter. In Commercial, SMB revenues were up 6.0% and Enterprise revenues were upwards 5.ane%, or 5.viii% if excluding low-margin wholesale revenues. Advertising Sales rebounded past a potent 65% yr-on-year to $411m, which was 4.1% higher than Q2 2019. Mobile revenues grew 68% (more than below).

Sequentially, Q2 2021 revenues grew two.2% but EBITDA simply grew ane.five%, largely attributable to college Regional Sports Networks costs, as a delayed starting time to the NBA flavor pushed more Laker games into Q2.

Q2'due south eleven.8% year-on-year EBITDA growth followed Q1'southward 12.5%, exceeding the long-term loftier-single-digit charge per unit nosotros assume, with both quarters having benefited from abode connectivity demand during the pandemic.

Video Losses Were Small and Stable

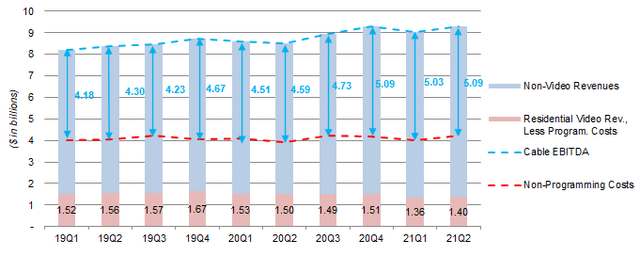

Equally with prior quarters, the gap between Video revenues and Programming Costs, a proxy for Gross Profit in the Video business organisation, was small relative to overall EBITDA and was broadly stable sequentially:

Lease Cablevision EBITDA vs. Video Revenues & Costs (Last 7 Quarters) Source: Charter visitor filings.

This proxy for Gross Profit in Video really rose slightly ($44m) from Q1, as Video revenues really rose $34m while Programming Costs barbarous $10m. Lease attributed this to higher sales in lower-priced Video packages.

FCF/Share Grew 42% After Buybacks

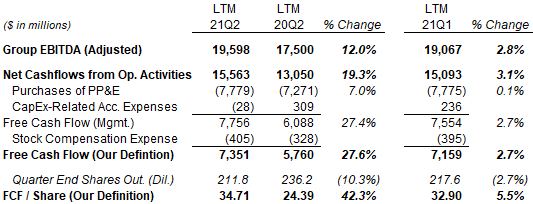

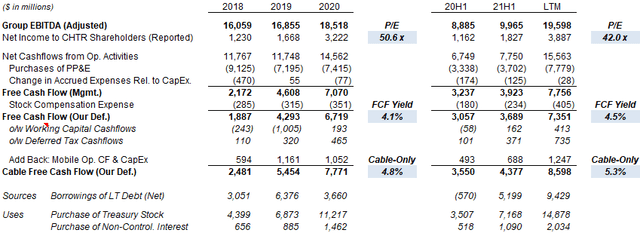

On last-twelve-month ("LTM") basis, Charter's EBITDA grew 12.0% yr-on-twelvemonth. Operational and fiscal leverage, including CapEx growing at a lower rate than EBITDA (even with CapEx rise from $463m to $759m), meant that LTM FCF grew much faster at 27.6%. Buybacks reduced the share count by 10.3% yr-on-yr, which meant LTM FCF/Share was up 42.3%:

Charter Cash flows (Q2 2021) Source: Charter company filings.

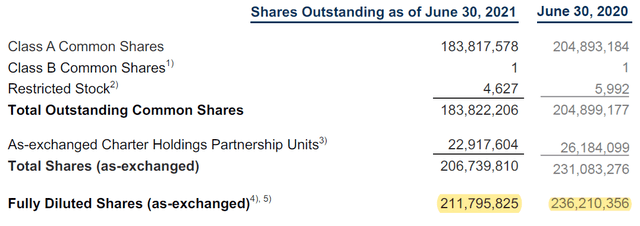

Charter repurchased vi.1m ($4.0bn) of shares at an boilerplate price of $656 per share in Q2, reducing the share count by 10.5% year-on-year:

Charter Diluted Share Count (Q2 2021 vs. Prior Year)  Source: Charter results presentations (Q2 2021 and 2020).

Source: Charter results presentations (Q2 2021 and 2020).

In improver to approx. $2.0bn of FCF during the quarter, Lease too increased its long-term debt past $3.1bn, with Net Debt / EBITDA at 4.38x, compared to a target of existence at the mid-to-high cease of a 4.0-4.5x range.

Charter converted its $two.5bn of Advanced/Newhouse preferred partnership units in June, removing $150m of annual preferred dividend payments; these shares were already included in the diluted share count in the by.

There is no explicit target for the buybacks, merely they are Lease'southward master tool of returning capital letter to shareholders, and management stated their thinking is focused on reaching the target leverage ratio.

Mobile: Growing Fast and Narrowing Losses

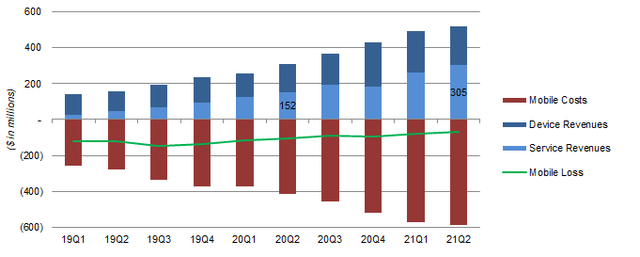

Lease'due south Mobile business continued to grow strongly and to narrow its losses. Total Mobile revenues were 67.v% higher year-on-yr in Q2 2021; excluding device revenues, service revenues had doubled from $152m to $305m:

Charter Mobile Revenues & Costs (Since 2019) Source: Lease company filings.

The number of Mobile lines has grown 73% year-on-twelvemonth to ii.94m.

The Mobile business organization had a reported loss of $67m in Q2, downward from $103m in the prior-twelvemonth quarter. Management had stated in the by that it was already profitable excluding sales and marketing when it reached two.0m customers.

Nosotros look growth in the Mobile concern to accelerate further subsequently the disruptive effects of COVID-19 on sales action have disappeared, and once Charter has completed its retail store ringlet-out by the finish of 2021.

We are now confident this will be a cloth profit driver in the future.

Leverage & Buybacks Remain Powerful Drivers

Nosotros continue to believe that leverage and buybacks will help accelerate a high-single-digits EBITDA growth to at least a high-teens FCF/Share growth.

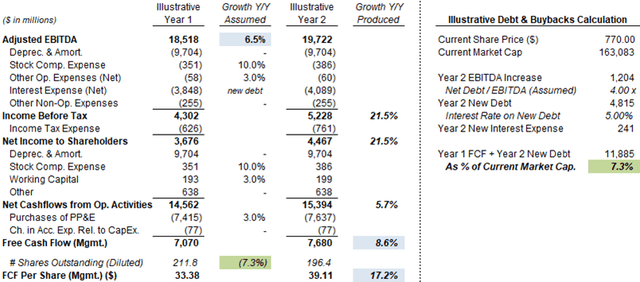

The table beneath is an updated version of our illustrative per-share calculations (last shown in September 2020), which shows how an example half-dozen.5% EBITDA growth could turn into a loftier-teens FCF/Share growth:

Illustrative Charter EBITDA & FCF Growth Calculations Source: Librarian Capital estimates.

In our illustrative calculations, a 6.5% increase in EBITDA, with financial leverage and CapEx growing slower, would lead to an eight.half-dozen% increase in FCF. It would besides provide, when leveraged at the low-finish of the 4.0-iv.5x Net Debt / EBITDA target, $4.8bn of new debt. Adding this to FCF of $7.1bn ways $11.9bn of buyback capacity, which at today'due south share toll would allow seven.three% of shares to be repurchased, accelerating FCF/Share growth to 17.two%.

Is Charter Stock Overvalued?

At $770.00, relative to 2020 financials, Charter stock is trading at a 50.6x P/E and a 4.i% FCF Yield (four.viii% excluding Mobile losses). Relative to LTM financials, the P/East is 42.0x and the FCF Yield is 4.v% (five.3% excluding Mobile):

Charter Earnings, Cash flows & Valuation (2017-xx) NB. Assumes conversion of Advance/Newhouse preferred. Source: Charter company filings.

We continue to believe that Lease shares should trade at a 4.0% FCF Yield.

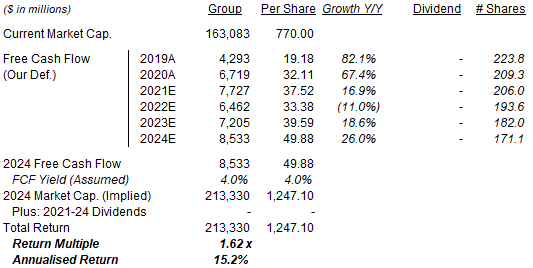

Lease Stock Forecast

Excluding Mobile losses, Charter's LTM FCF of $8.60bn is already college than our 2021 forecast of $viii.16bn (based on a 5% growth).

Management no longer provides a separate Cablevision-only FCF (excluding Mobile). We alter our return forecasts to focus on group FCF appropriately.

We now presume a 2021 group FCF growth of 15%, from a H2 growth of approx. 10%. (H1 group FCF was 21% college twelvemonth-on-year.) We besides now assume a $0.5bn contribution from Mobile in 2024.

Our key assumptions at present include:

- 2021 FCF growth of 15.0% (was 5.0% on Cablevision-just FCF)

- 2022 FCF to grow by 11.5% pre-taxation, but reduced 25% by taxation (unchanged)

- 2023 FCF to abound past eleven.5% (unchanged)

- 2024 FCF to grow by 11.5% + $500m (was just 11.5%)

- 2021 share count of 206.0m (was 200.9m)

- From 2022, share count to be reduced by half dozen.0% each year (was 4.0%)

- Exit valuation of a 4.0% FCF Yield on FCF (unchanged)

Our new 2024 group FCF/Share approximate of $49.88 is 4.5% higher than our previous Cablevision-only FCF/Share approximate of $47.73:

Illustrative Charter Return Forecasts Source: Librarian Capital estimates.

With shares at $770.00, nosotros expect an exit price of $1,247 and a total render of 62% (fifteen.two% annualized) by 2024 year-end, in just under 3.5 years.

Is CHTR Share a Buy? Determination

Q2 2021 results showed how each of the key components in our investment case for Lease Communications continues to progress.

Structural growth in Internet revenues continued. Internet internet adds were 400k customers in Q2 and 10% above pre-COVID 2019 in H1.

Losses in Video remained small and steady, margin expanded again, and leverage plus buybacks accelerated FCF/share growth to 42%.

Mobile doubled service revenues twelvemonth-on-year and narrowed its losses. Nosotros are now confident this volition be a material profit generator in the hereafter.

With shares at $770.00, we expect an exit price of $1,247 and a total return of 62% (15.two% annualized) by 2024 year-finish, in just under 3.five years.

We reiterate our Buy rating on Charter Communications, Inc.

Notation: A track record of my past recommendations tin can exist found here.

This article was written past

Global, long-term, fundamentally-oriented & full-bodied investing. With more than ten years' buy-side feel, I look at stocks globally and across industries, with a focus on the U.S. and U.K.. My investing manner can best be described as "Quality Growth" or "Growth At a Reasonable Price". (previously writing under the name "Blue Heaven Capital" until December 2019)

Disclosure: I/we have a benign long position in the shares of CHTR,CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I accept no business human relationship with any company whose stock is mentioned in this commodity.

Source: https://seekingalpha.com/article/4445643-charter-q2-internet-net-adds-above-2019-multi-year-growth-continuing

0 Response to "what to expect from charter communications inc. in 2019"

Post a Comment